Sep

Blockchain and Carbon Credits: A New Era of Transparent Climate Action

In the face of mounting global pressure to address climate change, carbon credits have emerged as a vital tool to offset greenhouse gas emissions. Yet, the system has long suffered from opacity, inefficiency, and mistrust. Enter blockchain — a disruptive technology with the power to redefine how we monitor, verify, and trade carbon credits on a global scale. By infusing the carbon market with unprecedented transparency and decentralization, blockchain may be the key to restoring confidence and scaling climate action at the speed the planet demands.

This article delves into how blockchain is revolutionizing the carbon credit landscape, creating a more accountable, traceable, and effective system for mitigating climate change.

What Are Carbon Credits?

Carbon credits are tradable certificates or permits that represent the right to emit a specific amount of carbon dioxide (CO₂) or an equivalent amount of another greenhouse gas (GHG). One carbon credit equates to one metric ton (1,000 kilograms) of CO₂-equivalent emissions.

They are used as part of global climate strategies to reduce greenhouse gas emissions by setting a financial cost on emitting carbon. This mechanism incentivizes organizations to reduce their emissions or invest in projects that counterbalance them.

Types of Carbon Credits

Carbon credits fall into two main categories, depending on the regulatory framework under which they are created and traded:

1. Compliance-Based Carbon Credits

These are credits created and traded under legally binding regulatory systems, often established by governments or international agreements. Organizations in certain industries—such as energy, aviation, or manufacturing—are required by law to hold a specific number of carbon credits to cover their emissions.

These schemes include, for example:

- The European Union Emissions Trading Scheme (EU ETS)

- California Cap-and-Trade Programmer

- International mechanisms under the Paris Agreement

If a company exceeds its emissions allowance, it must purchase additional credits to remain in compliance. If it emits less, it can sell its excess credits on the market.

2. Voluntary Carbon Credits

Voluntary credits are not legally required, but are purchased by companies, institutions, or individuals who wish to offset their emissions for ethical, environmental, or reputational reasons. This is often part of broader corporate social responsibility (CSR) efforts or commitments to net-zero targets.

These credits are typically issued by projects that meet criteria set by independent certification bodies such as:

- Verra (Verified Carbon Standard)

- Gold Standard

- Climate Action Reserve

- American Carbon Registry

The voluntary market operates alongside compliance markets and offers flexibility and innovation in project design and financing.

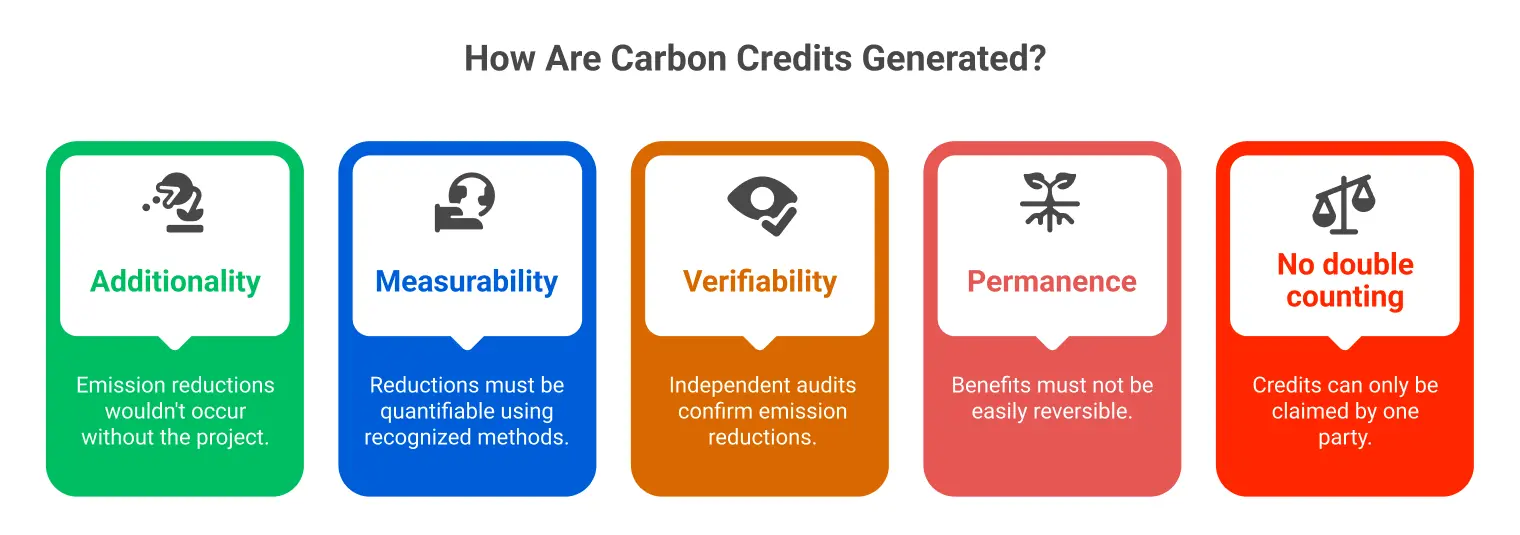

How Are Carbon Credits Generated?

Carbon credits are created through projects that reduce, avoid, or remove greenhouse gas emissions. Each project must meet strict criteria to ensure its environmental impact is real, measurable, and lasting. These requirements usually include:

- Additionality : The project must lead to emission reductions that would not have occurred without the project.

- Measurability : Reductions must be quantifiable using recognized methods.

- Verifiability : Independent third-party audits must confirm the emission reductions.

- Permanence : The benefits must not be easily reversible.

- No double counting : Credits can only be claimed by one party.

Common Types of Projects Generating Carbon Credits:

Renewable Energy Projects

These include the development of solar farms, wind turbines, hydroelectric facilities, and other sources that generate clean electricity. Such projects replace fossil fuel-based energy generation, thus reducing overall emissions.

Reforestation and Afforestation

Trees naturally absorb CO₂ through photosynthesis. Planting trees on degraded or deforested land (reforestation) or in areas where there were no previous forests (afforestation) helps remove carbon from the atmosphere and store it in biomass and soil.

Methane Capture

Methane is a far more potent greenhouse gas than CO₂. Projects that capture methane from landfills, agricultural operations (such as manure management), or wastewater treatment facilities prevent it from being released into the atmosphere and may also use it as a renewable energy source.

Soil Carbon Sequestration

Changes to agricultural practices can increase the amount of carbon stored in soil. Techniques such as no-till farming, cover cropping, and composting help trap atmospheric carbon and improve soil health at the same time.

Energy Efficiency Improvements

Projects that reduce the energy consumption of buildings, machinery, or transportation systems also qualify. This includes retrofitting buildings, upgrading equipment, and improving insulation or lighting systems, all of which reduce emissions associated with energy use.

The Challenges Facing Traditional Carbon Credit Systems

Despite their promise, traditional carbon markets have faced several major obstacles:

1. Lack of Transparency

The current carbon credit system frequently functions in isolated networks with limited data sharing. Purchasers often lack real-time access to crucial details such as the source of the credits or their actual environmental impact. This opacity undermines trust and hinders the ability to make informed decisions.

2. Double Counting

Double counting occurs when the same carbon offset is claimed by multiple parties—either across countries or between buyers and project developers. This inflates the perceived climate benefit and results in inaccurate reporting of global emission reductions. Such discrepancies threaten the credibility of carbon markets.

3. Fraud and Greenwashing

Due to the complexity of verifying emissions reductions, some entities exploit the system to make misleading environmental claims. This may involve buying cheap, ineffective offsets or overstating climate contributions. The result is reputational risk and diminished public confidence in genuine sustainability efforts.

4. High Transaction Costs

The traditional process of issuing and verifying carbon credits often involves numerous intermediaries and lengthy bureaucratic steps. These layers increase costs, meaning that a smaller proportion of funds goes directly to the environmental projects themselves. This inefficiency limits the scale and impact of the system.

5. Limited Accessibility

Small businesses, grassroots initiatives, and developing countries frequently encounter obstacles when attempting to participate in carbon markets. These challenges include complex regulatory requirements, high entry costs, and inadequate digital infrastructure. As a result, many valuable climate projects remain unregistered and unsupported.

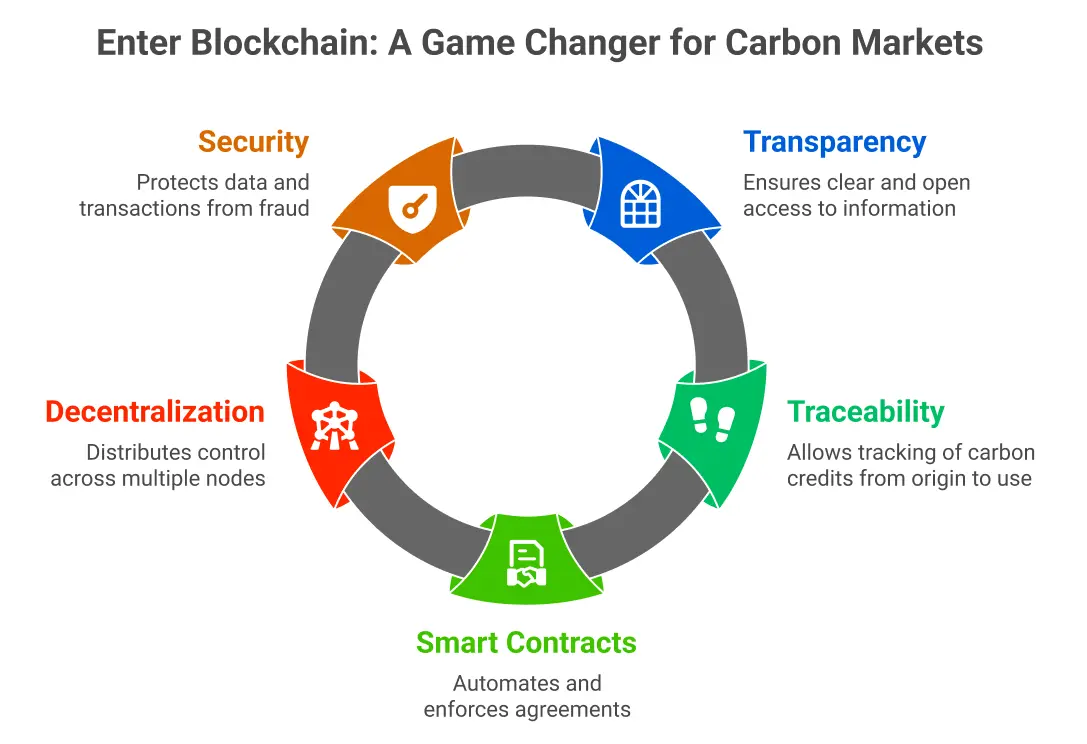

Enter Blockchain: A Game Changer for Carbon Markets

Blockchain is a decentralized, digital ledger technology that records data in a secure, transparent, and tamper-proof manner. Unlike traditional systems that rely on centralized databases and intermediaries, blockchain distributes information across a network of computers, making it highly resilient and trustworthy.

This unique structure offers powerful advantages for improving the credibility, efficiency, and inclusiveness of carbon credit markets. Below is a breakdown of the key features of blockchain and how they directly address the systemic issues within the carbon offset system.

Transparency

Blockchain records all transactions on a public, immutable ledger that anyone can access. This means every carbon credit’s origin, transfer, and retirement is visible in real-time. It significantly reduces the chance of hidden or duplicate transactions, building trust across the system.

Traceability

Each carbon credit can be assigned a unique digital ID and tracked from creation to retirement. Blockchain ensures a clear, unbroken chain of custody for every credit. This traceability helps prevent double counting and ensures credits are genuine and properly accounted for.

Smart Contracts

Smart contracts are automated agreements that execute actions once conditions are met. In carbon markets, they can manage the issuance, verification, and retirement of credits without human error. This streamlines processes and reduces administrative delays and corruption risks.

Decentralization

Blockchain operates without central authority, distributing power across a network. This reduces reliance on intermediaries and enhances system resilience. It also allows broader participation, giving access to smaller organizations and developing countries often excluded from traditional systems.

Security

Blockchain uses cryptographic techniques to secure data and prevent tampering. Every transaction is verified and time-stamped, ensuring accuracy and authenticity. This safeguards carbon credit information against fraud and manipulation, enhancing trust in the system.

How Blockchain Works in Carbon Credit Markets

Here’s how blockchain transforms the carbon credit lifecycle:

1. Issuance

Carbon credits are initially created and recorded on a blockchain platform in a digital format. This stage includes essential project details to ensure each credit is unique and traceable.

- Tokenization : Each carbon credit is issued as a digital asset or non-fungible token (NFT), making it distinct and securely trackable.

- Project Metadata : Every token includes key information such as:

- Type of project (e.g. reforestation, renewable energy)

- Geographic location of the project

- Methodology used to calculate emission reductions

- Date the credit was issued

- Certification standard followed (e.g. Verra, Gold Standard)

- Immutable Record : Once recorded on the blockchain, this information cannot be altered, ensuring transparency and integrity.

2. Verification

Verification is critical to confirm that a project has genuinely achieved measurable carbon reductions. Blockchain enhances this step through automation and advanced technologies.

- Data Integration : Blockchain platforms can incorporate real-time data from:

- IoT sensors measuring forest growth, energy output, or soil carbon levels

- Satellite imagery to monitor land use and environmental changes

- AI and analytics to validate and analyze collected data

- Third-party Validation : Independent auditors can access the data directly from the blockchain, improving accuracy and speeding up the verification process.

- Tamper-proof Audits : Verification logs are securely recorded, providing a transparent audit trail that builds trust among market participants.

3. Trading

Once verified, carbon credits can be traded between parties in a secure, decentralized environment. Blockchain simplifies this process and improves market access.

- Decentralized Marketplaces : Credits are listed on blockchain-based platforms, allowing peer-to-peer transactions without central intermediaries.

- Payment Flexibility : Trades can be settled in cryptocurrencies (e.g. Ethereum) or traditional fiat currencies.

- Smart Contracts : Automated agreements execute trades instantly when set conditions are met (e.g. payment confirmation, buyer eligibility).

- Global Accessibility : Companies, investors, or individuals worldwide can buy and sell credits with transparency and ease.

4. Retirement

Retirement is the final step in the lifecycle of a carbon credit, marking it as used and ensuring it cannot be reused or claimed again.

- Permanent Record : When a credit is retired, it is marked accordingly on the blockchain and removed from circulation.

- Prevents Double Counting : This transparent, public record eliminates the possibility of the same credit being sold or claimed multiple times.

- Environmental Assurance : Buyers can verify that their purchased credit has been properly retired, ensuring the offset was legitimate.

- Audit Readiness : Retired credits are stored immutably, allowing regulatory bodies or auditors to confirm proper use at any time.

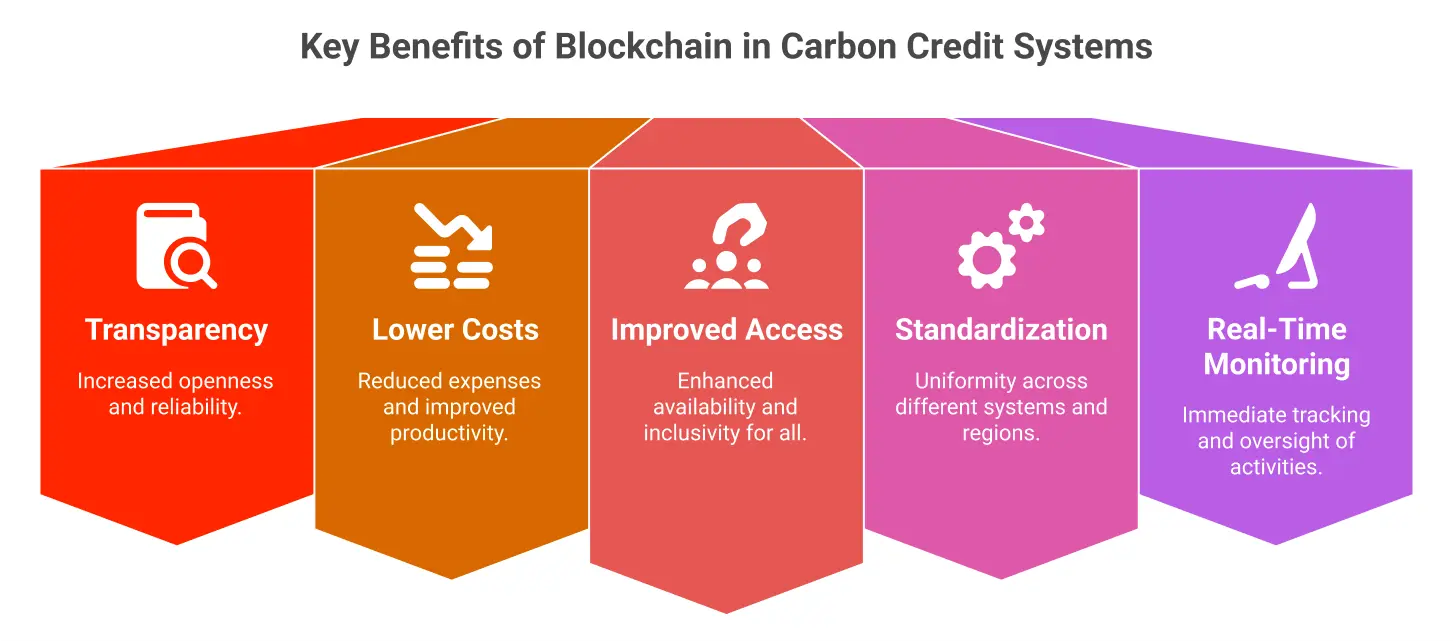

Key Benefits of Blockchain in Carbon Credit Systems

Transparency and Trust

Blockchain strengthens the integrity of carbon markets by providing a secure, transparent audit trail for each credit.

- Immutable Records : Every transaction, from issuance to retirement, is permanently recorded and publicly accessible.

- Reduced Fraud : The open nature of the ledger prevents the falsification of credit data and deters dishonest practices.

- Increased Confidence : Stakeholders can independently verify the source and status of credits, building trust in the system.

Lower Costs and Greater Efficiency

By automating processes and removing middlemen, blockchain significantly reduces administrative and transaction costs.

- Smart Contracts : These self-executing programmers handle credit issuance, transfer, and retirement automatically.

- Fewer Intermediaries : Reduced reliance on brokers and manual auditors lowers operational costs.

- More Funding to Projects : A larger share of climate finance reaches the actual environmental initiatives.

Improved Access and Inclusion

Blockchain’s decentralized nature creates more inclusive carbon markets, particularly for underrepresented regions and small-scale actors.

- Open Participation : Anyone with internet access can register and trade credits on decentralized platforms.

- Empowerment of Small Projects : Local communities and NGOs can participate without expensive regulatory barriers.

- Greater Equity : Developing nations gain more opportunities to fund and certify their climate initiatives.

Global Standardization

Blockchain paves the way for consistent global carbon credit systems, making international cooperation more seamless.

- Unified Protocols : Shared data and verification standards can be encoded into blockchain architecture.

- Cross-Standard Compatibility : Credits issued under various methodologies (e.g. Verra, Gold Standard) can interoperate.

- Efficient Cross-Border Trading : A standardized digital infrastructure supports international offset markets and compliance frameworks.

Real-Time Monitoring

With integrated technologies, blockchain enables continuous monitoring and reporting of project performance.

- Live Data Feeds : IoT devices and satellite imaging provide constant environmental measurements.

- Automated Verification : AI analyses incoming data, flagging discrepancies and validating outcomes.

- Adaptive Climate Action : Real-time insights allow for timely adjustments to project management and policy responses.

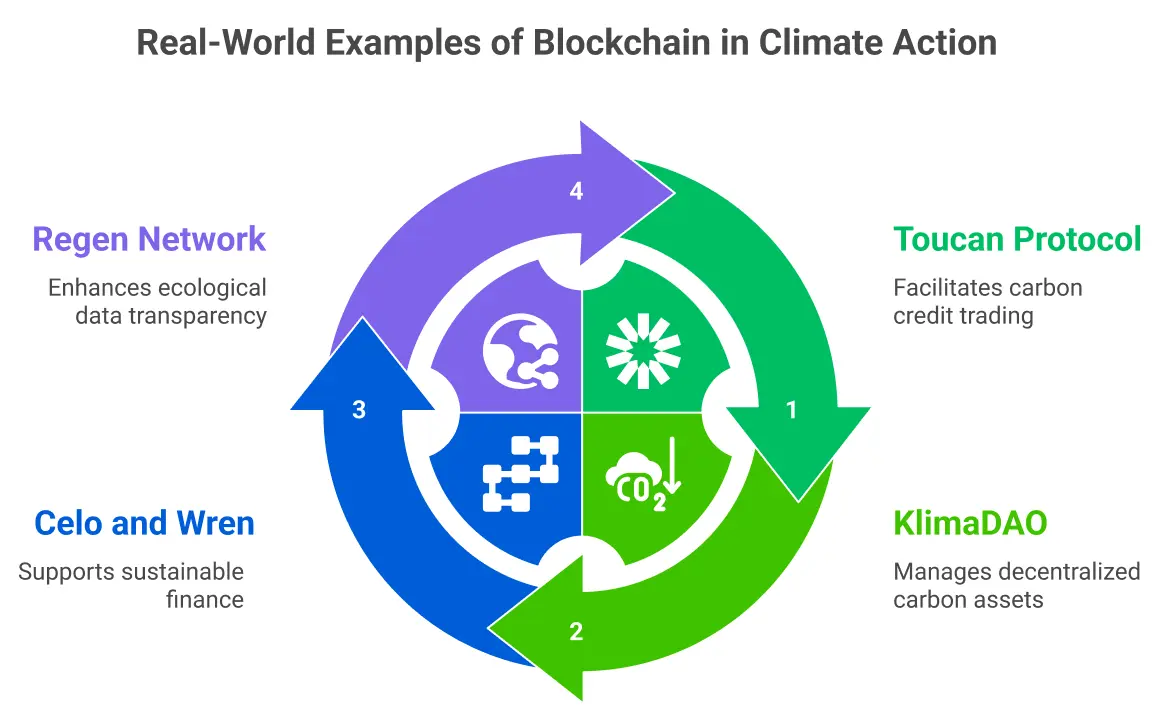

Real-World Examples of Blockchain in Climate Action

Toucan Protocol

Toucan Protocol has developed a blockchain-based infrastructure designed to tokenize existing carbon credits, effectively bridging the gap between traditional carbon markets and the world of decentralized finance (DeFi). At the core of Toucan’s system is the Base Carbon Tonne (BCT), a digital asset representing one tone of verified carbon offset. This tokenization process allows legacy carbon credits—typically issued by registries such as Verra—to be brought onto the blockchain, where they can be traded, retired, or used within decentralized applications. By increasing the liquidity and accessibility of carbon credits, Toucan aims to create a more transparent and efficient carbon market.

KlimaDAO

KlimaDAO is a decentralized autonomous organization built on top of the Toucan Protocol, designed to increase the demand for carbon offsets through blockchain and cryptographic incentives. It operates by purchasing and locking tokenized carbon credits such as BCT, effectively removing them from circulation and ensuring their environmental impact. Participants in the KlimaDAO ecosystem are rewarded with governance tokens, which provide voting rights and financial incentives, thereby encouraging ongoing participation. By using blockchain to track every transaction and retirement, KlimaDAO ensures a high level of transparency, contributing to the development of a circular and sustainable climate economy.

Celo and Wren

Celo is a blockchain platform with a strong focus on financial inclusion and environmental sustainability. It has partnered with Wren, a platform that enables individuals and organizations to fund verified carbon removal projects. Together, they facilitate direct investment in climate initiatives such as reforestation, clean cookstoves, and carbon sequestration. Using smart contracts, the collaboration ensures that funds are allocated transparently and automatically to certified projects without unnecessary intermediaries. This approach not only improves the efficiency of climate finance but also empowers individuals to contribute meaningfully to carbon reduction efforts through a decentralized, trustless system.

Regen Network

Regen Network is a blockchain project focused on regenerative agriculture and ecological stewardship. It creates ecological credits based on real-world environmental improvements such as soil carbon sequestration, biodiversity enhancement, and watershed restoration. Unlike conventional carbon credits, Regen’s assets are tied to measurable ecological outcomes and verified through scientific methods. By placing these credits on a blockchain, Regen ensures they are transparent, tradable, and traceable. The platform supports farmers, landowners, and local communities by financially recognizing and rewarding their efforts to restore and maintain healthy ecosystems, making sustainable land management economically viable.

Key Technologies Empowering the Ecosystem

Non-Fungible Tokens (NFTs)

NFTs are unique digital tokens that represent individual carbon credits on the blockchain. They embed essential certification data such as project type, origin, and verification standards. This ensures that each credit is traceable, tamper-proof, and cannot be duplicated or misused. It adds a new layer of transparency to carbon trading.

Decentralized Oracles

Decentralized oracles connect the blockchain with real-world data sources like satellite imagery and weather stations. They feed verified external data into smart contracts, supporting accurate project validation. By decentralizing data inputs, oracles help prevent manipulation and enhance trust in carbon offset reporting.

IoT Devices

Internet of Things (IoT) devices are used in the field to measure environmental conditions, including soil carbon, methane levels, and deforestation rates. These sensors transmit real-time data directly to blockchain platforms. This allows for more frequent and accurate monitoring of emission reduction projects.

Artificial Intelligence (AI)

AI processes large volumes of environmental data to assess project performance and detect anomalies. It can identify potential fraud, verify impact claims, and predict future outcomes. By automating analysis, AI reduces costs and speeds up the carbon credit validation process.

Potential Risks and Limitations

While promising, blockchain’s integration with carbon markets also presents challenges:

Energy Usage

Some blockchain platforms have high energy requirements, raising concerns about their environmental impact.

- Energy-Intensive Protocols : Blockchains like Bitcoin rely on proof-of-work (PoW), which consumes significant electricity.

- Greener Alternatives : Modern platforms such as Ethereum 2.0 and Celo use proof-of-stake (PoS), which drastically reduces energy usage and aligns better with climate goals.

- Perception Issues : Despite improvements, blockchain’s energy reputation may still deter adoption in climate-sensitive sectors.

Regulatory Uncertainty

The lack of clear legal frameworks creates hesitation around blockchain-based carbon credits.

- Lack of Global Standards : Most countries do not yet have formal regulations for digital or tokenized carbon credits.

- Institutional Hesitation : Regulatory ambiguity makes it difficult for large investors and governments to participate confidently.

- Compliance Challenges : Uncertainty over how tokenised credits align with national or international climate policies may limit scalability.

Market Fragmentation

Multiple platforms with different rules can undermine the efficiency and interoperability of blockchain-based carbon markets.

- No Common Framework : Projects operate on varying standards, making integration and comparison difficult.

- Redundant Solutions : Competing blockchains may duplicate efforts rather than contribute to a unified market.

- User Confusion : Lack of standardization may discourage participation from businesses and offset buyers unfamiliar with the technology.

Technical Barriers

Adopting blockchain requires infrastructure and expertise, which are not always accessible in all regions.

- Knowledge Gaps : Many stakeholders lack the technical literacy to understand or implement blockchain solutions.

- Infrastructure Limitations : Developing countries may face connectivity issues or lack access to the required digital tools.

- Training and Support : Widespread adoption will require education programmes and user-friendly platforms.

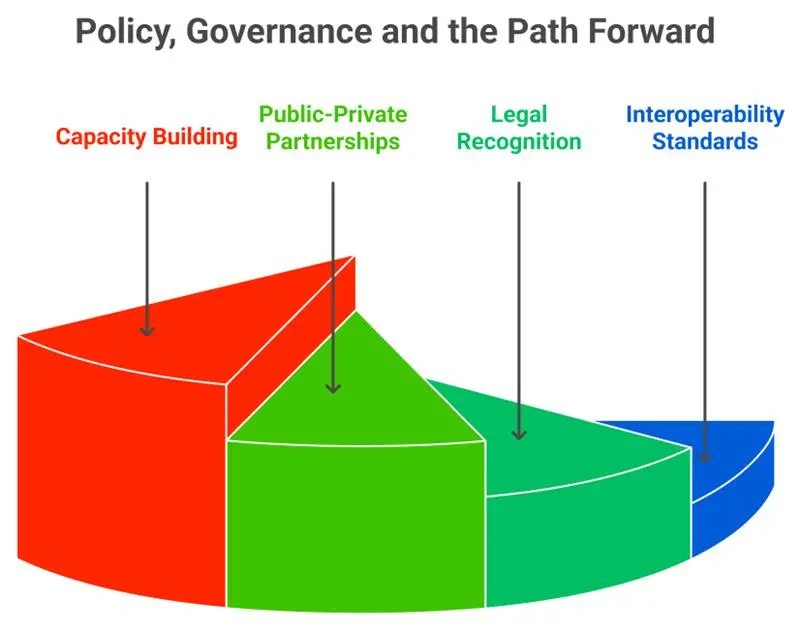

Policy, Governance and the Path Forward

Interoperability Standards

Establishing interoperability standards is essential for creating a unified and effective blockchain-based carbon market. By ensuring that different blockchain platforms and carbon registries can communicate and exchange data seamlessly, governments and international bodies can reduce fragmentation, avoid duplication, and promote greater trust and transparency across the system. These shared standards will be key to supporting global cooperation on climate action.

Legal Recognition

Governments must formally recognize tokenized carbon credits as legitimate and enforceable assets. Without clear legal status, these digital instruments may struggle to gain credibility in regulated carbon markets or among institutional investors. Legal frameworks that define ownership, accountability, and transferability of tokenized credits will help integrate blockchain into national and international climate strategies.

Public-Private Partnerships

Public-private partnerships are vital for scaling blockchain-based climate solutions. By collaborating with technology providers, environmental organizations, and academic institutions, governments can help fund innovation, conduct pilot programmers, and drive adoption of new systems. These partnerships enable a shared approach to solving complex challenges and accelerating progress toward net-zero goals.

Capacity Building

Widespread adoption of blockchain in carbon markets depends on educating stakeholders and building technical capacity. Many participants, especially in developing regions, lack the knowledge or resources to engage with these emerging technologies. Governments and international organizations should invest in training, infrastructure, and support systems to ensure that all actors can participate meaningfully in the evolving digital climate economy.

The Future: Web3, Carbon Markets and Climate Justice

Incentivizing Sustainable Behavior

Web3 technologies enable individuals to earn carbon tokens as rewards for adopting eco-friendly habits such as cycling, reducing energy use, or choosing renewable energy sources. These tokens act as both incentives and proof of positive environmental impact, encouraging widespread behavioral change at the personal level.

Empowering Local Communities

Communities engaged in conservation efforts—such as reforestation, regenerative agriculture, or biodiversity preservation—can monetize their work through blockchain. By tokenizing these contributions, they gain direct access to global carbon markets without relying on intermediaries, ensuring a more equitable share of climate finance.

Democratizing Climate Finance with DAOs

Decentralized Autonomous Organizations (DAOs) provide a governance model where funding decisions are made transparently and collectively. Community members and stakeholders can vote on how climate funds are allocated, which projects to support, and how to measure impact, fostering greater trust and accountability.

Shifting Power to Citizens

Traditional carbon markets are often controlled by large corporations and institutions. Web3 offers a decentralized alternative where individuals and communities have greater influence. This shift empowers citizens to participate in climate action directly, creating a more inclusive and responsive system.

Advancing Climate Justice

Web3 climate solutions are not only about emissions reduction but also about fairness. By design, these systems can prioritize support for marginalized groups, indigenous communities, and regions most affected by climate change. This ensures that the benefits of carbon markets are shared more equitably and contribute to long-term social and environmental resilience.

Conclusion

Blockchain is not a silver bullet, but it is undoubtedly a powerful catalyst for reforming carbon credit systems. By ensuring transparency, reducing costs, and decentralizing access, blockchain has the potential to restore credibility and scale up climate action worldwide. For carbon markets to truly deliver on their promise, they must evolve — and blockchain is providing the technological backbone for that transformation.

Frequently Asked Questions

Carbon credits represent a permit or certificate that allows a company to emit a certain amount of CO₂ or equivalent greenhouse gases. They are crucial in incentivizing businesses to reduce emissions and support global climate action.

Blockchain ensures transparency, traceability, and immutability, making it possible to verify transactions and prevent double-counting of carbon credits.

The conventional system struggles with fraud, lack of transparency, double-selling, and high administrative costs, reducing trust in the market.

Yes. Since blockchain records are immutable and verifiable, it reduces the chances of fake credits, double-counting, and manipulation.

Smart contracts automate processes such as issuance, trading, and retirement of carbon credits, ensuring compliance without intermediaries.

Governments, businesses, environmental organizations, and individuals benefit through greater trust, cost efficiency, and easier access to verified credits.

Recognition depends on integration with regulatory frameworks and international climate agreements, but adoption is growing rapidly.

Blockchain provides real-time monitoring, transparent reporting, and permanent records for projects like reforestation, renewable energy, and carbon capture.

Yes. Many platforms allow individuals to buy, trade, or retire verified carbon credits, supporting sustainability while offsetting their personal carbon footprint.

Blockchain has the potential to standardize carbon markets, encourage global participation, and accelerate the transition to a transparent, trustworthy green economy.